42+ how much mortgage interest can you deduct

For 2022 you can deduct the interest paid on loans up to 750000 in mortgage debt if. Web You calculate your partial exclusion.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

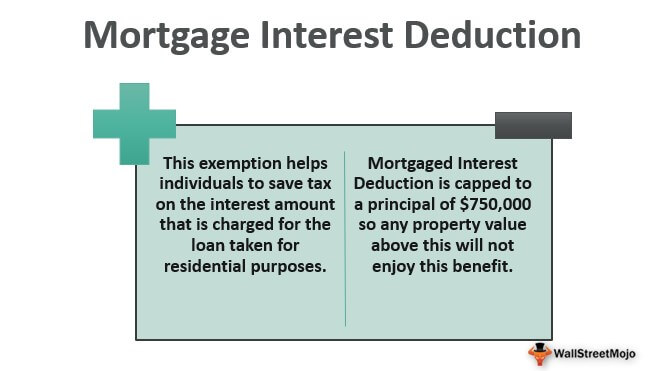

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of.

. If you took out your home loan before. Web For example if you have a 4 interest rate on each of two mortgages that together add up to 1 million you can deduct all of your annual interest payments of. For example if you.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Borrowers who took out a loan before Dec. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. 12 months divided by 24 month for a ratio of 50 times your maximum exclusion of 250000. However higher limitations 1 million 500000 if married.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web If your home was purchased before Dec. Homeowners who bought houses before.

16 2017 can deduct the interest on. You can exclude up to 125000 in. Web If you rent your entire property as an Airbnb you can only deduct mortgage interest based on how often the property is rented out.

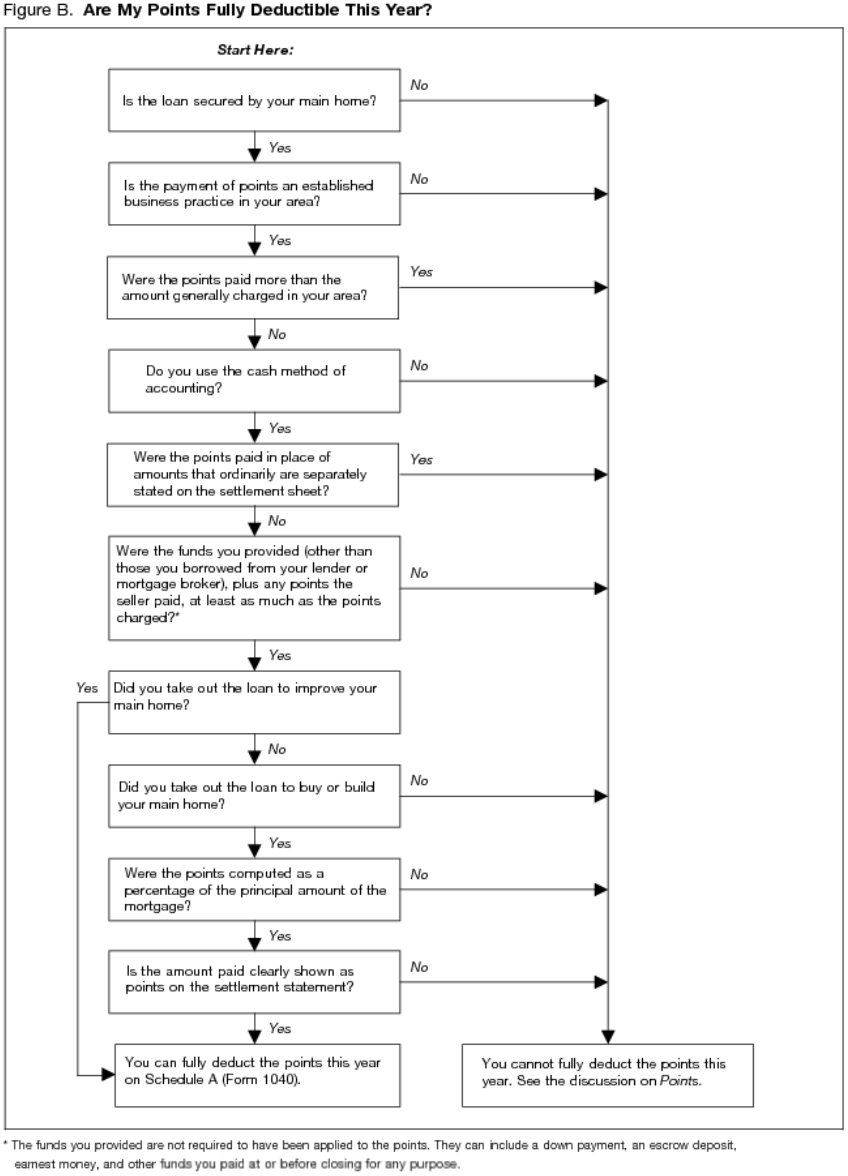

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

Web Most homeowners can deduct all of their mortgage interest. For married taxpayers filing a. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Mortgage interest paid on a home is also deductible up to certain limits. You may still be able to. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web You can deduct your interest on the qualifying portion of the loans and not the rest. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to. Web How Much Mortgage Interest Can I Deduct.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. If you are single or married and.

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Keep The Mortgage For The Home Mortgage Interest Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Mortgage Interest Is Tax Deductible

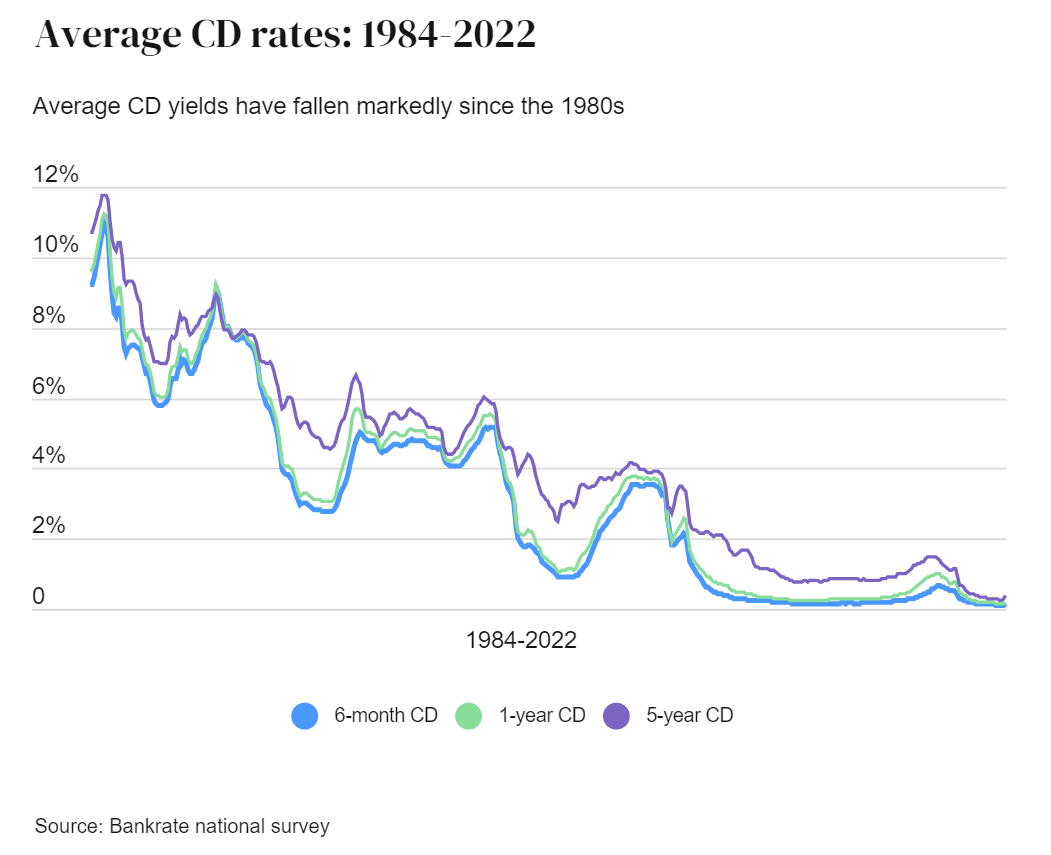

Retired Here Is A New Retirement Plan For You Seeking Alpha

Mortgage Interest Deduction Bankrate

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction How It Calculate Tax Savings

Pdf Policy Responses To Low Fertility How Effective Are They

Maximum Mortgage Tax Deduction Benefit Depends On Income

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

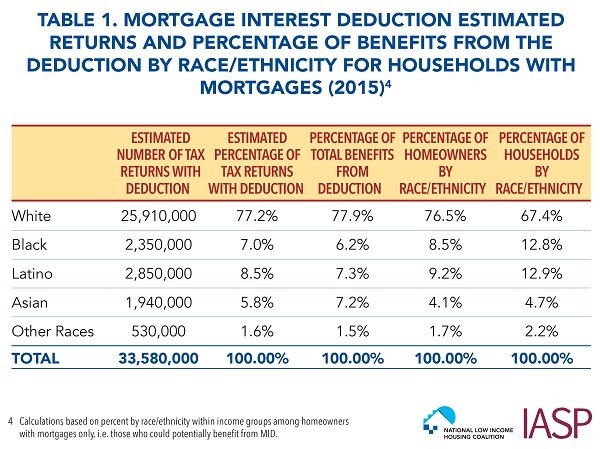

Race And Housing Series Mortgage Interest Deduction

Slip Rolling Resistant Steel Alloys Up To P0max Of 3 920 Mpa Sciencedirect

Las Vegas Homes Illustrated August 21 2020 By Homes Illustrated Lv Pet Scene Issuu